The Ultimate Guide on Private Equity for Entrepreneurs

Private equity is a type of investment that involves acquiring equity stakes in privately held companies. It is often used by investors seeking to generate high returns by investing in companies with strong growth potential. For entrepreneurs, private equity can be a valuable source of funding, particularly during the early stages of growth.

4.9 out of 5

| Language | : | English |

| File size | : | 14553 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 159 pages |

| Lending | : | Enabled |

Types of Private Equity

There are several different types of private equity, including:

- Venture capital: This type of private equity is typically invested in early-stage companies with high growth potential.

- Growth equity: This type of private equity is invested in companies that have already demonstrated some success and are looking to expand their operations or enter new markets.

- Buyout equity: This type of private equity is used to acquire a majority stake in a company, typically with the goal of restructuring or improving its operations.

- Distressed equity: This type of private equity is invested in companies that are facing financial distress, with the goal of turning them around and generating returns.

Benefits of Private Equity

There are several benefits to investing in private equity, including:

- High potential returns: Private equity investments have the potential to generate high returns, particularly for early-stage investments.

- Diversification: Private equity can provide diversification to an investment portfolio, as it is typically invested in a variety of different companies and industries.

- Growth opportunities: Private equity investors often work closely with the management teams of the companies they invest in, providing guidance and support to help them grow and succeed.

- Access to capital: Private equity can provide entrepreneurs with access to capital that may not be available from traditional sources, such as banks or venture capitalists.

Drawbacks of Private Equity

There are also some potential drawbacks to private equity, including:

- High fees: Private equity firms typically charge high fees for their services, which can reduce the returns to investors.

- Lock-up periods: Private equity investments typically have lock-up periods, which restrict investors from selling their shares for a certain period of time.

- Illiquidity: Private equity investments are typically illiquid, meaning that it can be difficult to sell them quickly if needed.

- Risk: Private equity investments can be risky, and there is no guarantee that they will generate positive returns.

Exit Strategies

There are several different exit strategies that private equity investors can use to sell their investments, including:

- Initial public offering (IPO): This involves selling the company's shares to the public through an IPO.

- Sale to another company: This involves selling the company to another company, either through an acquisition or a merger.

- Secondary sale: This involves selling the company's shares to another private equity firm.

- Recapitalization: This involves selling the company's shares back to the management team or to a group of investors.

How to Raise Private Equity Funds

There are several ways that entrepreneurs can raise private equity funds, including:

- Pitching to private equity firms: This involves presenting your business plan to private equity firms and trying to convince them to invest in your company.

- Using a placement agent: This involves hiring a placement agent to help you find and connect with potential investors.

- Attending industry events: Attending industry events, such as conferences and trade shows, can provide opportunities to meet with potential investors.

- Networking: Networking with other entrepreneurs, investors, and professionals can help you raise awareness of your company and attract potential investors.

Private equity can be a valuable source of funding for entrepreneurs, particularly during the early stages of growth. However, it is important to understand the different types of private equity, the benefits and drawbacks of investing in private equity, and the various exit strategies that are available. By carefully considering all of these factors, entrepreneurs can make informed decisions about whether or not private equity is right for their businesses.

4.9 out of 5

| Language | : | English |

| File size | : | 14553 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 159 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Story

Story Genre

Genre Library

Library Paperback

Paperback Magazine

Magazine Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Bibliography

Bibliography Foreword

Foreword Preface

Preface Footnote

Footnote Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Narrative

Narrative Memoir

Memoir Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Character

Character Catalog

Catalog Card Catalog

Card Catalog Stacks

Stacks Study

Study Scholarly

Scholarly Reserve

Reserve Academic

Academic Journals

Journals Rare Books

Rare Books Special Collections

Special Collections Literacy

Literacy Study Group

Study Group Dissertation

Dissertation Awards

Awards Reading List

Reading List Theory

Theory Eli Berman

Eli Berman Autumn Kalquist

Autumn Kalquist Kit Perez

Kit Perez Alex Pentland

Alex Pentland Elsie Chapman

Elsie Chapman Il Divo

Il Divo Kate Mcgahan

Kate Mcgahan Kristen Hogrefe

Kristen Hogrefe Aaron Smith

Aaron Smith Vivian Ice

Vivian Ice Geling Yan

Geling Yan Alex Kemp

Alex Kemp Todd Mikkelsen

Todd Mikkelsen Katrina Kahler

Katrina Kahler Chitra Soundar

Chitra Soundar Henry Cloud

Henry Cloud Cynthia Woolf

Cynthia Woolf Brian C Kalt

Brian C Kalt Herman Geuvers

Herman Geuvers Amanda Schell

Amanda Schell

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Cristian CoxThe Ultimate Sweden High Coast Visitor Guide: Explore the Natural Beauty of...

Cristian CoxThe Ultimate Sweden High Coast Visitor Guide: Explore the Natural Beauty of...

Percy Bysshe ShelleyPrepare for Penguin Trouble with Flash Forward Lego Batman Step Into Reading

Percy Bysshe ShelleyPrepare for Penguin Trouble with Flash Forward Lego Batman Step Into Reading

Dillon HayesAdvancements and Innovations in Crisis and Emergency Management: Enhancing...

Dillon HayesAdvancements and Innovations in Crisis and Emergency Management: Enhancing... Donovan CarterFollow ·10.5k

Donovan CarterFollow ·10.5k Edison MitchellFollow ·2.3k

Edison MitchellFollow ·2.3k Anthony WellsFollow ·15.5k

Anthony WellsFollow ·15.5k Jeffrey CoxFollow ·17.5k

Jeffrey CoxFollow ·17.5k Keith CoxFollow ·8.1k

Keith CoxFollow ·8.1k Jedidiah HayesFollow ·10.5k

Jedidiah HayesFollow ·10.5k Ivan TurgenevFollow ·7.1k

Ivan TurgenevFollow ·7.1k J.R.R. TolkienFollow ·8.4k

J.R.R. TolkienFollow ·8.4k

Al Foster

Al FosterHow To Breathe Underwater: Unlocking the Secrets of...

: Embracing the...

Ian Mitchell

Ian MitchellThe Laws of Gravity: A Literary Journey into the...

Lisa Ann Gallagher's...

Francis Turner

Francis TurnerChristmas Solos For Beginning Viola: A Detailed Guide for...

Christmas is a time for...

Jamal Blair

Jamal BlairDefine Humanistic Psychology Forms Of Communication...

Humanistic...

Morris Carter

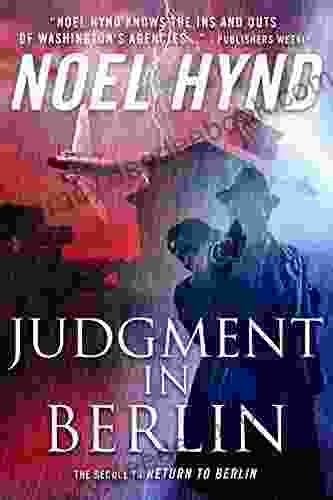

Morris CarterJudgment in Berlin: Unraveling the Intrigue of an...

"Judgment in Berlin" is a gripping...

4.9 out of 5

| Language | : | English |

| File size | : | 14553 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 159 pages |

| Lending | : | Enabled |